As you all are already aware in today’s world of innovation development, everyone wants to do most of their day-to-day errands on the tips of their hands, either on handsets or PCs. But this even paves some hacking risks; one such widely used app in the phone and web application is Phonepe. There are certain apps to trick users, and one such app in broader use by pranksters is the Phonepe spoof app.

It is an application that mimics the most popular transaction entreaty utilized by many people daily, especially in India. Today with the development of the latest technology, UPI or advanced wallets are gaining a lot of public interest. But then, security is one such important point that users need to be sure about before entrusting it to more significant causes.

This is to inform all such users that your search ends here; in the below article, we will provide you with complete guidelines in the same regard to avoid any of such applications or programming and to be like prey in any of such cases.

Table of Contents

What is the Phonepe Spoof apk?

With the improvement of the world of innovation, people are becoming more tech-savvy, which paves the path for some additional issues. One rising problem is the online transaction industry, where users have started online billings due to their hectic time slots.

This brought the existence of an application that certainly has no connection with the official stage of Phonepe, I.e., the Phonepe spoof apk.

This provides a platform for the cheater to swindle the users. This app may seem official, but it’s a fake android app. It allows people to commit fraud and cheat innocent faces.

It provides a very user-friendly interface; below depicted is some additional information:

- Version: v2.0.2

- Required Android: 4.4 and Up

- Price: free

- Size: 25 MB

It is very similar to the original application,

The main feature of the payment phonepe spoof app is that Fake payment receipts are generated easily. Also, it Generates of Real transaction ID, an exact copy of Phonepe, and some unlimited passes.

Download: Phonepe spoof apk

See also: 10 Best Free Fake WhatsApp Chat Generator Tools (2022)

How To Download The Phonepe Spoof App?

Here’s the steps to download the Phonepe spoof application on android and PC.

On Android

Follow the below steps to download the application on your android.

- You will first need to download the app file.

- Users can select the apk file from the list of versions.

- After this, you must go to your android’s security and privacy via the settings app.

- Then, you have to click on ‘Install unknown sources.’

- Lastly, it would help if you reverted to the browser window with the download file and tapped on “install.”

- This would help you to download Phonepe fake payment apk quite effectively on your android.

See also: 13 Best Online Fake Person Generator

Tools in 2023

On PC

Follow the below steps to download the application on your PC.

- Firstly, you need to install the Bluestack App player on your system.

- Then via Bluestacks, download and install the latest version of the Phonepe spoof app.

- You will then need to connect your Pc to Android using Bluetooth or USB.

- You can then smoothly run the downloaded Phonepe spoof app on your system in your browser’s window.

See also: 13 Best Online Fake Tweet Generators Tools [Latest 2023]

Working Of Phonepe Spoof / Phonepe fake Payment App

The existence of a fake Phonepe payment web is entirely mysterious. Today, when everyone prefers to use online payment modes, this app favors all those cheaters who want to dupe society.

The word “spoof” itself means to ‘deceive.’ And people of all age groups like the elderly, middle-aged, and most often the youngsters fall prey to this shit. This application has the same features and specifications as the original one and has become more accessible to gain access.

Fake payment receipts are generated through this app, which renders the users persuaded. But as for real, there is no deposit of money in users’ bank accounts. Instead, it allows the fake third party to get entangled in their transactions. This application makes no secured bill payments, recharge, or other possible; instead, it is just a fake, fraudulent application on the web.

See also: 4 Websites to Generate Fake Airline Tickets or Boarding Passes

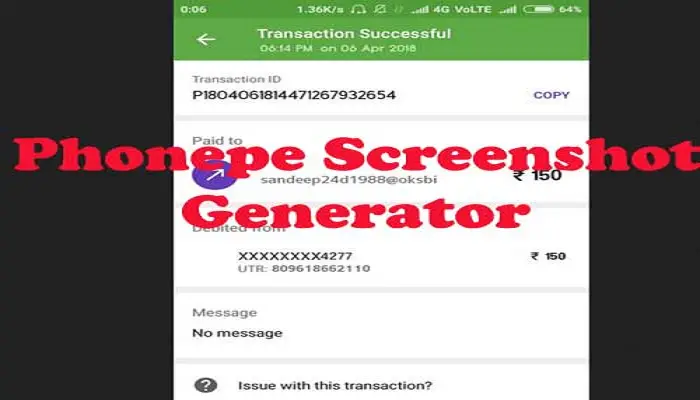

Phonepe Fake Payment Screenshot Generator

This is to inform all the users about detailed evidence of how cheaters generate fake payments through the Phonepe spoof app.

Comparing the fake screenshots to the real ones makes it harder to recognize the substantial ones. Because of this, no. of victims of this is on the increase. But with proper knowledge and alertness, any future consequences can be prevented.

See also: 14 Best Random Address Generator Tools in 2022

How To Generate a Fake Payment of Phonepe Online Transaction?

- Firstly users need to visit the phonepe fake payment generator page.

- There you are; you need to enter the required details like the receiver’s name, bank account number, transaction id, amount, time, date, etc.

- After filling in the essentials, you can submit it to generate the demo transaction screenshot on your screens.

- By saving this image, you can download a fake screenshot.

Through the procedure mentioned above, we do not entertain any fraud. Instead, it is for providing the exact data to the users, which will help them stay vigilant.

See Also: How To Verify Device On PhonePe? Complete Guide

How To Differentiate Between The Original And Fake Payment Screenshots?

- Users must first evaluate the Phonepe application on their devices and go through all the transaction procedures.

- Then it would help if you looked into your record exchange history.

- Users can also compare the textual styles, illustrations, and billings if done on a valid date and time.

- It isn’t easy to distinguish between them, but the above method may help you recognize the actual and fake scripts via the Phonepe spoof app.

See also: Free Fake Name Generator | 7 Best Online Tools [Updated]

Prank Payment Apk

It is a very easy-to-use app for fooling friends and family into believing that you have thousands in your account. The best part is that it’s free of charge. It can be used to share large payment screenshots with your friends, mainly for pranking and recreational purposes.

This prank payment apk has gained a lot of fame in the last few years as the graphics are pretty impressive, and it even allows you to take fake payment screenshots.

FAQs

Can you list some best phonepe fake screenshot generating tools?

It can be by two methods: This is by downloading the phonepe fake payment screenshot maker apk and receiving the phonepe fake payment screenshot generating the application from a friend.

Where can we use fake phonepe spoof app payment screenshots?

This can be done to pray pranks over friends and for other entertainment purposes only. No other illegal or fraudulent stuff should be promoted.

Is the Phonepe spoof apk legal?

This app is entirely illegal. Today because of these, many people are facing lots of problems and are rendering easy access to cheaters.

Are there any other spoofing payment applications on the web?

As for the payments, there is another unique app called Spoof Payment Apk; it is easy to use and creates a fake charge receipt.

How can we make safe UPI payments?

Before making any transactions using UPI, users need to ensure their systems' security. Keep yourself updated regarding the frauds taking place in society. Also, update your PC according to the latest adaptation of the program.

Conclusion

Phonepe spoof app isn’t a legit or legal application. The above manuscript solely focuses on educators and preventive measures for the users. Having complete and precise information will prevent users from getting duped by cheaters. With the help of the above data, we hope users can get their thoughts clearance about the latest Phonepe spoof apk download.

It is not advised to download or use such apps. We merely request the users to stay safe and cautious and protect themselves from being a victim of any of such frauds.

We tried to clear all the queries in this regard, and any further doubts are welcomed at any point.

See also: 15 Best Websites for Free Unlimited Spoof Calling (Latest)